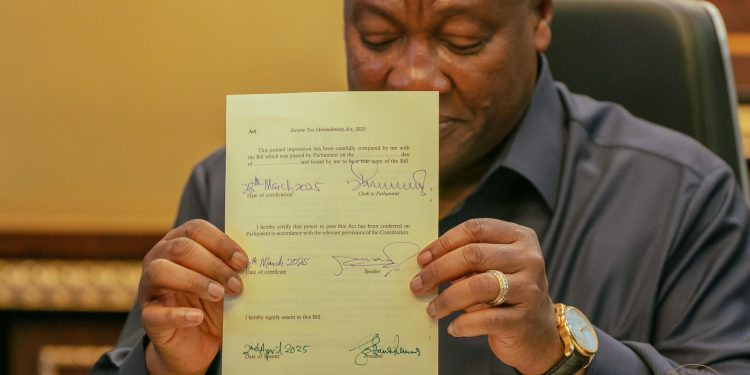

President John Dramani Mahama has enacted a comprehensive set of tax and financial reforms aimed at revitalizing Ghana’s economy and improving fiscal management.

The newly signed bills mark a significant restructuring of the country’s taxation framework, signaling the government’s intent to ease financial burdens on citizens while boosting economic activity.

One of the most notable changes is the repeal of the Electronic Transfer Levy (E-Levy), which previously imposed a 1% tax on mobile money and electronic transactions. This move has been widely welcomed by individuals and businesses who viewed the levy as an impediment to digital financial inclusion and commerce.

Additionally, the Emissions Levy has been scrapped, removing taxes that had been a source of frustration for vehicle owners and industries.

The government has also introduced amendments to the Value Added Tax (VAT) system to promote economic growth and align with evolving market needs.

Further reforms include updates to the Income Tax Act, which now eliminates the controversial betting tax, a move expected to impact Ghana’s growing gaming industry.

The Petroleum Revenue Management Amendment seeks to optimize the allocation of funds from oil revenues, while the Public Financial Management Amendment strengthens fiscal responsibility and transparency in government spending.

Other key legislative changes include modifications to levies in the energy sector, a realignment of earmarked funds for greater efficiency, and the establishment of a Gold

Board to oversee regulatory improvements in gold production and revenue management.

The Finance Ministry has expressed confidence that these measures will reduce the overall tax burden, enhance compliance, and attract investment.

Industry analysts anticipate that the reforms will play a crucial role in stabilizing Ghana’s economy while fostering sustainable growth.

President Mahama’s approval of these bills underscores his administration’s commitment to addressing economic challenges and implementing policies that benefit the nation.

Source: NewsandVibes.com